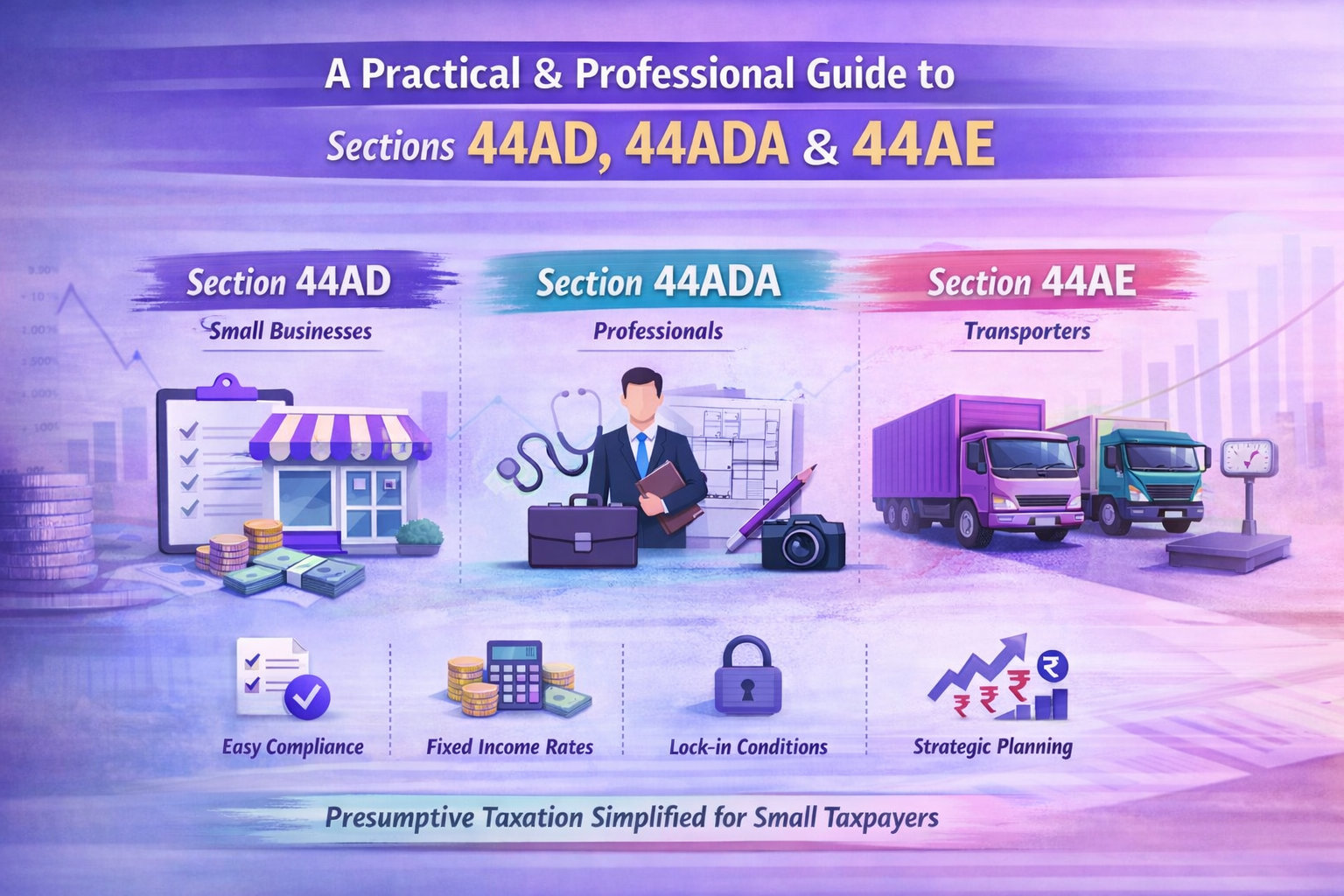

A Practical & Professional Guide to Sections 44AD, 44ADA and 44AE

1. Introduction: Why Presumptive Taxation Matters

The Indian Income-tax Act traditionally requires taxpayers to maintain detailed books of account, undergo audits, and comply with extensive reporting norms. While essential for large and complex businesses, these requirements often become burdensome for small businesses and professionals.

To address this imbalance, the Legislature introduced the Presumptive Taxation Scheme, with the objective of:

- Simplifying income computation

- Reducing compliance and audit burden

- Encouraging voluntary tax compliance

- Bringing small and unorganised taxpayers into the formal tax system

The scheme is primarily governed by Sections 44AD, 44ADA, and 44AE of the Income-tax Act, 1961. These provisions allow eligible taxpayers to declare income on a deemed basis, without maintaining detailed books or undergoing audit, subject to prescribed conditions.

This blog provides a clear, structured, and practical overview of these provisions, along with compliance insights and strategic considerations.

2. Understanding Presumptive Taxation

Presumptive taxation is based on a statutory presumption that a fixed percentage of gross receipts or turnover represents the taxpayer’s income. When validly opted:

- Books of account under section 44AA are not required

- Audit under section 44AB is not applicable

- Income is computed on a deemed basis, irrespective of actual profit

Key Characteristics:

- No separate deduction of expenses

- Higher income may be voluntarily declared

- Depreciation is deemed to be allowed

- Certain schemes impose exit restrictions

3. Section 44AD – Presumptive Taxation for Small Businesses

3.1 Who Can Opt for Section 44AD?

Eligible Assessees

- Individual

- Hindu Undivided Family (HUF)

- Partnership Firm (excluding LLP)

Not Eligible

- Companies and LLPs

- Non-residents

- Professionals covered under section 44AA(1)

- Agency, commission or brokerage businesses

3.2 Turnover Limit

- Standard limit: ₹2 crore

- Enhanced limit: ₹3 crore, provided cash receipts and payments do not exceed 5% (as introduced by Finance Act, 2023)

3.3 Presumptive Income Rates

Presumptive Income Rates under Section 44AD

- Digital receipts: Income deemed at 6% of such receipts

- Cash receipts: Income deemed at 8% of such receipts

This differential rate promotes digital transactions and transparency.

3.4 Deductions & Compliance

- No deductions under sections 30 to 38

- Partner’s remuneration and interest deemed allowed

- Depreciation deemed allowed (WDV adjusted)

Advance Tax: Entire liability payable by 15th March.

3.5 Lock-in Provision

If income is declared below the presumptive rate in any of the next five years:

- Section 44AD cannot be opted for the next five assessment years

- Books of account become mandatory

- Audit under section 44AB applies (if income exceeds basic exemption limit)

3.6 Example

A trader has turnover of ₹1.20 crore:

- Digital receipts: ₹80 lakh × 6% = ₹4.80 lakh

- Cash receipts: ₹40 lakh × 8% = ₹3.20 lakh

Total Presumptive Income: ₹8,00,000

4. Section 44ADA – Presumptive Taxation for Professionals

Introduced by the Finance Act, 2016, section 44ADA extends presumptive taxation benefits to specified professionals.

4.1 Eligible Assessees

- Resident Individual

- Resident Partnership Firm (excluding LLP)

4.2 Eligible Professions

Professions covered under section 44AA(1), including:

- Legal, Medical, Engineering, Architecture

- Accountancy and Technical Consultancy

- Interior Decoration and other notified professions

4.3 Threshold & Income Rate

- Gross receipts limit: ₹50 lakh

- Presumptive income: 50% of gross receipts or higher

(No distinction between cash and digital receipts)

4.4 Compliance Aspects

- No separate expense deduction

- Depreciation deemed allowed

- Advance tax payable by 15th March

If income is declared below 50%:

- Books of account become mandatory

- Audit required if income exceeds basic exemption limit

- No lock-in period, unlike section 44AD

4.5 Example

A Chartered Accountant earns ₹42 lakh during the year:

- Presumptive income: ₹21 lakh

- Tax computed without claiming any further expenses

5. Section 44AE – Presumptive Taxation for Transporters

Section 44AE applies to taxpayers engaged in the business of plying, hiring, or leasing goods carriages.

5.1 Eligibility

- Applicable to any assessee, including companies, LLPs and non-residents

Condition: Not more than 10 goods vehicles owned at any time during the year.

5.2 Presumptive Income

Presumptive Income under Section 44AE

- Heavy goods vehicle: ₹1,000 per ton of gross vehicle weight per month (or part thereof)

- Other goods vehicle: ₹7,500 per vehicle per month (or part thereof)

Income is calculated based on ownership period, not actual usage.

5.3 Key Features

- No turnover limit

- No lock-in period

- Expenses and depreciation deemed allowed

6. Comparison at a Glance

Comparison of Presumptive Taxation Schemes

- Section 44AD: Applicable to eligible businesses; turnover limit of ₹2 crore (₹3 crore subject to cash limits); presumptive income at 6% / 8%; five-year lock-in applies.

- Section 44ADA: Applicable to specified professionals; gross receipts up to ₹50 lakh; income deemed at 50%; no lock-in period.

- Section 44AE: Applicable to transporters owning up to 10 goods vehicles; income computed per vehicle per month; no turnover limit and no lock-in.

7. Judicial & Practical Principles

Courts have consistently held that:

- Presumptive income is a legal fiction and must be applied in full

- Expenses cannot be separately claimed once the scheme is adopted

- The department cannot insist on books if presumptive income is accepted

- Declaring higher income is always permissible

8. Strategic Considerations Before Opting

Presumptive taxation should be evaluated carefully, considering:

- Actual profit margins

- Capital investment and depreciation impact

- Funding and banking documentation needs

- GST reconciliation and reporting requirements

- Long-term scalability of the business or profession

9. Common Mistakes in Practice

- Applying section 44AD to commission or brokerage income

- Opting section 44ADA for LLP professionals

- Claiming expenses after presumptive income

- Ignoring depreciation impact on WDV

- Violating lock-in provisions under section 44AD

Conclusion

The presumptive taxation regime under sections 44AD, 44ADA, and 44AE offers a practical balance between ease of compliance and tax certainty for small taxpayers. However, these schemes are not one-size-fits-all.

For businesses and professionals, a case-specific evaluation is essential to ensure that presumptive taxation results in genuine tax efficiency without future compliance complications. Proper professional guidance remains key to leveraging these provisions effectively and lawfully.