Introduction

Filing an Income Tax Return (ITR) within the prescribed due date is one of the most fundamental compliance obligations under the Indian Income Tax Act. Yet, every year, a significant number of taxpayers—ranging from salaried individuals and professionals to business owners and startups—miss the deadline for various reasons. These reasons may include lack of awareness, incomplete documentation, dependence on third parties, technical issues on the income tax portal, or simply underestimating the consequences of delay.

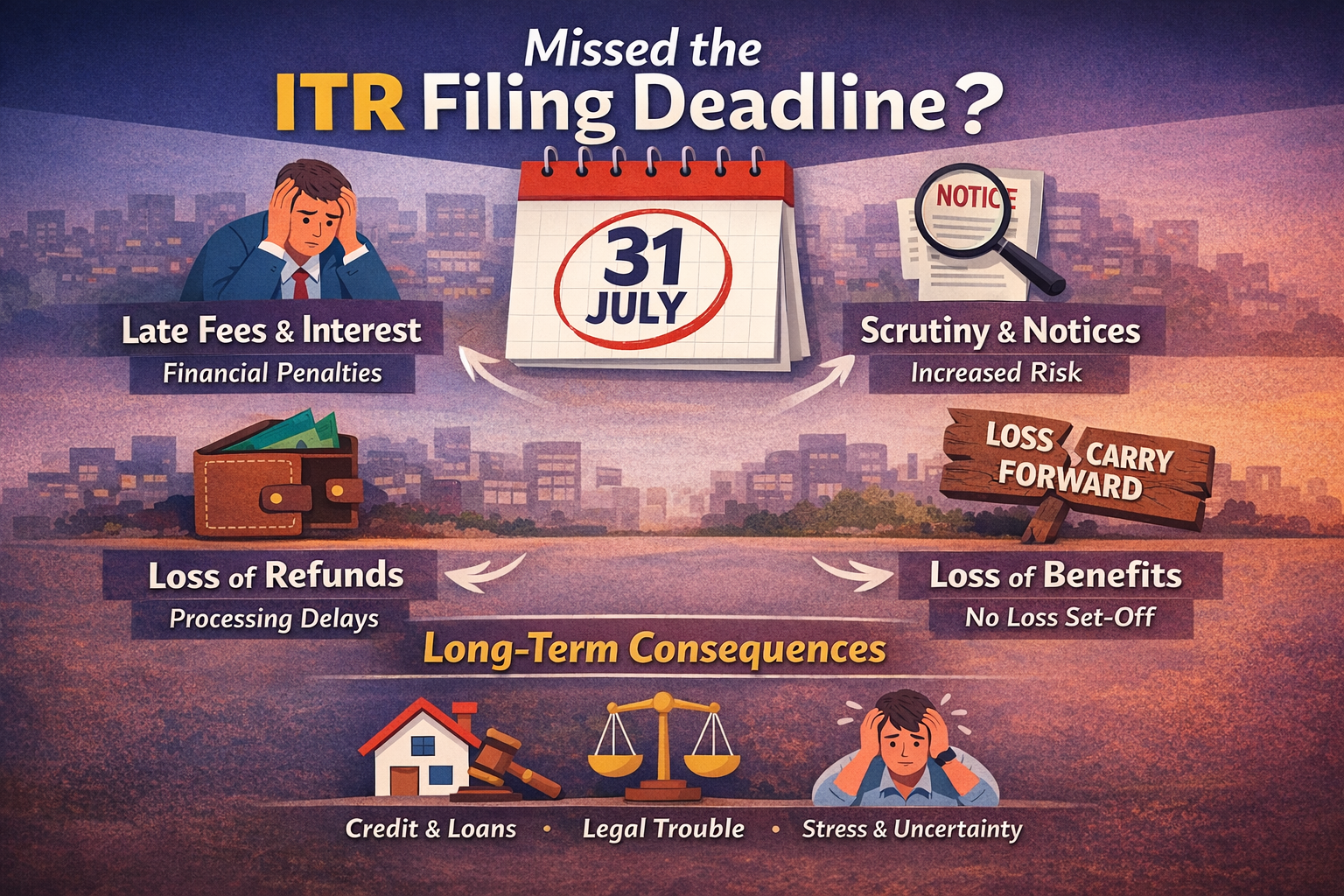

A common misconception among taxpayers is that missing the ITR filing deadline only attracts a late fee. In reality, the implications of delayed filing extend far beyond monetary penalties. Missing the due date can affect refund eligibility, interest liability, loss carry-forward benefits, scrutiny exposure, creditworthiness, future compliance history, and even legal standing.

This article provides an in-depth, professional, and structured explanation of what actually happens when you miss the ITR filing deadline, why the law treats timely filing as critical, and how delayed compliance can create long-term financial and legal consequences—even when no tax is payable.

Understanding the Importance of the ITR Due Date

The due date for filing an Income Tax Return is not an arbitrary timeline. It is designed to enable orderly processing of returns, verification of data, assessment of tax liabilities, issuance of refunds, and enforcement of compliance mechanisms.

From the perspective of the tax administration, timely filing allows the Income Tax Department to:

- Match income reported with third-party data

- Identify discrepancies early

- Process refunds efficiently

- Maintain fiscal discipline

- Plan revenue projections

From the taxpayer’s perspective, filing within the due date protects statutory rights and ensures access to benefits explicitly linked to timely compliance.

Who Is Required to File ITR Within the Due Date

Contrary to popular belief, the obligation to file an ITR is not limited to taxpayers who owe tax. Filing may be mandatory even when the final tax payable is nil.

Individuals, entities, or professionals may be required to file returns if they satisfy conditions relating to:

- Income thresholds

- Specific transactions

- Claiming refunds

- Carry forward of losses

- Regulatory or statutory requirements

Failure to comply within the due date automatically converts a regular return into a belated return, triggering multiple statutory consequences.

Immediate Legal Consequence: Conversion into a Belated Return

When the due date for filing an ITR expires, the taxpayer does not immediately become non-compliant in an irreversible manner. The law provides a second opportunity in the form of a belated return.

However, this flexibility comes at a cost. A belated return is treated differently from a return filed within the due date, both procedurally and substantively.

The filing of a belated return acknowledges that the taxpayer has failed to meet the statutory deadline, thereby exposing them to penalties, interest, loss of benefits, and increased scrutiny risk.

Late Filing Fee: Not Just a Penalty, but a Compliance Signal

One of the most visible consequences of missing the ITR deadline is the late filing fee. This fee is mandatory and applies regardless of whether tax is payable or not.

The rationale behind imposing a late fee is not merely punitive. It serves as a compliance signal, indicating that the taxpayer failed to adhere to statutory timelines.

Importantly, the late fee is:

- Automatically calculated

- System-driven

- Non-discretionary

- Not waivable except under specific government relaxations

Many taxpayers incorrectly assume that the late fee applies only if tax is payable. In reality, even a nil-tax return attracts a late fee once the due date is missed.

Interest Liability: The Silent Financial Drain

While the late fee is a one-time cost, interest liability continues to accumulate until compliance is completed.

Interest is charged on unpaid tax liabilities, including:

- Self-assessment tax

- Advance tax shortfalls

- TDS mismatches

Even when the taxpayer believes that all taxes have been deducted at source, minor mismatches can result in interest liability that compounds over time.

The key issue is that interest is calculated automatically, and taxpayers often become aware of it only when filing belated returns or receiving intimation from the department.

Loss of Refund Priority and Processing Delays

Taxpayers who are eligible for refunds often assume that filing late will merely delay the refund. In practice, delayed filing can create multiple complications.

Refund claims in belated returns are typically:

- Processed later than timely returns

- Subject to additional verification

- Prone to mismatch queries

- Delayed due to backlog prioritisation

Moreover, the department tends to prioritise processing of returns filed within the due date, especially during peak assessment cycles.

This delay can significantly impact taxpayers who rely on refunds for cash flow planning, particularly salaried individuals and small businesses.

Forfeiture of Carry Forward of Losses: A Permanent Financial Impact

One of the most severe yet least understood consequences of missing the ITR filing deadline is the loss of carry forward of certain losses.

Losses that require timely filing include:

- Business losses

- Speculative losses

- Capital losses

Once the due date is missed, these losses cannot be carried forward, even if the return is subsequently filed.

This consequence is permanent and irreversible. Unlike late fees or interest, which involve monetary payment, loss of carry-forward benefits can result in substantial future tax liabilities, especially for businesses and investors.

Impact on Business and Professional Tax Planning

For businesses and professionals, delayed filing has implications beyond the current financial year.

Late filing can affect:

- Tax audit timelines

- Credit assessments

- Banking relationships

- Investor confidence

- Regulatory compliance status

In many cases, financial institutions and stakeholders rely on timely filed returns as evidence of financial discipline and transparency. Repeated delays may weaken credibility and negotiating power.

Increased Probability of Notices and Scrutiny

While missing the ITR deadline does not automatically lead to scrutiny, it increases risk exposure.

The Income Tax Department’s risk management systems factor in compliance behavior, including:

- Timeliness of filing

- Consistency in reporting

- History of defaults

Belated returns are more likely to be selected for verification due to their deviation from statutory timelines.

This does not imply wrongdoing, but it does mean higher compliance oversight.

Restriction on Revision Rights

Timely filing preserves the taxpayer’s right to revise the return freely in case of errors or omissions.

Belated returns also allow revision, but the scope becomes narrower, and the time available for corrective action reduces significantly.

In complex cases involving capital gains, foreign income, or business reporting, reduced revision flexibility can increase compliance risk.

Effect on Prosecution and Penalty Exposure

In extreme cases of prolonged non-filing, the department may initiate penalty or prosecution proceedings.

While prosecution is generally reserved for serious defaults involving tax evasion, habitual non-compliance or intentional delay can attract stricter enforcement measures.

Timely filing acts as a protective shield against such escalation.

Psychological and Professional Stress

Beyond legal and financial consequences, missing the ITR deadline creates unnecessary stress for taxpayers.

The anxiety associated with:

- Notices

- Penalties

- Portal errors

- Professional follow-ups

often outweighs the effort required to file on time.

From a professional standpoint, timely filing reflects discipline, foresight, and compliance awareness.

Can the Consequences Be Mitigated After Missing the Deadline?

While missing the deadline has consequences, taxpayers are not without remedies.

Mitigation strategies include:

- Filing belated returns at the earliest

- Paying outstanding taxes and interest promptly

- Responding to notices professionally

- Maintaining accurate documentation

Early corrective action significantly reduces long-term impact.

Role of Tax Professionals in Late Filing Scenarios

Engaging a tax professional becomes particularly important when deadlines are missed.

Professionals help by:

- Assessing exposure accurately

- Advising on loss optimization

- Handling notices and intimations

- Ensuring legally sustainable responses

Professional intervention often prevents minor issues from escalating into major disputes.

Why the Law Emphasizes Timely Filing

The emphasis on due dates is not arbitrary. It reflects a broader policy objective of promoting voluntary compliance, transparency, and efficiency in tax administration.

Timely filing ensures:

- Data integrity

- Fair assessment

- Faster refunds

- Reduced litigation

From a systemic perspective, compliance timelines are essential for fiscal governance.

Conclusion

Missing the ITR filing deadline is not a trivial lapse. While the law allows belated filing, the consequences extend far beyond a simple late fee. Loss of carry-forward benefits, interest liability, delayed refunds, increased scrutiny risk, and long-term compliance impact make delayed filing a costly mistake.

Timely filing protects taxpayer rights, preserves financial benefits, and reinforces credibility. In an era of automated tax administration and data-driven enforcement, discipline in compliance is no longer optional—it is essential.

Taxpayers should view ITR filing not as a mere annual ritual, but as a critical component of financial planning and legal responsibility.